mississippi tax and tag calculator

Casual Sales Tax. With local taxes the total sales tax rate is between 7000 and 8000.

/cloudfront-us-east-1.images.arcpublishing.com/gray/YPUS3JJ3RVBLNJQ26CCG5JMPEQ.jpg)

Car Tag Prices Vary Across The State

Once you have the tax.

. Dealership employees are more in tune to tax rates than most government officials. Mississippi Salary Tax Calculator for the Tax Year 202223. Tag amount with penalities added with no.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Excise taxes are 45 cents per 100 of value with no special tax on ev or hybrid vehicles. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Mississippi Salary Tax Calculator for the Tax Year 202223. Restaurants In Matthews Nc That Deliver. Opry Mills Breakfast Restaurants.

Mississippi tax title license calculator. THIS ESTIMATE IS BASED ON THE VALUES YOU SUPPLY. Only on vehicles less than 10 years old and purchased from an individual.

Mississippi Income Tax Calculator 2021. And if you come to Mississippi from Illinois Hawaii Tennessee Florida. If you are unsure call any local car dealership and ask for the tax rate.

Tag amount plus Casual Sales Tax. Motor Vehicle Ad Valorem Tax Reduction Fund Legislative Tag Credit In order to provide a tax break to the. Income taxes are also progressive which means higher.

Dmv Office and Services. The tax assessor has a Tax Calculator to help you estimate the cost of your property taxes. Its income tax system has a top rate of just 500.

Tax Commissioner Please feel free to contact us if. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223. Your average tax rate is 1198 and your marginal tax rate.

In mississippi you pay privilege tax registration. Please call the office IF HELP IS NEEDED. - Select this method for used vehicles where the Purchase Price is known.

This is only an estimate of your tax due. Mississippi car tag calculator lamar county. Motor Vehicle Licensing main page Motor Vehicle Assessments rule.

For comparison the median home value in Mississippi is. Overall Mississippi has a relatively low tax burden. Virginia at 971 and Rhode Island at 1144 or the only states whose drivers pay more for tags on cars worth 24000.

Overview of Mississippi Taxes. The cost is a one-time fee of 2500 the vehicle must be at least 25 years old as of October of the year the tag is purchased. Mississippi car tag calculator lamar county.

Mississippi has a 7 statewide sales tax rate but also has 142 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0065 on. - Select this method if you have your last tag receipt. Mississippi Vehicle Tax Calculator.

The sales tax of 7 is the most common tax on. This is only an estimate based on the current tax rate and the approximate value of the property. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Sales Tax On Cars And Vehicles In Mississippi

Mississippi State Ifta Fuel Tax File Ifta Online Ifta Tax

The Top 7 Mississippi Veteran Benefits Va Claims Insider

Mississippi License Plates Are Sometimes Expensive Due To Local Proper

Mississippi Sales Tax Calculator Reverse Sales Dremployee

Mississippi State Tax H R Block

How To Register A Car In Mississippi Yourmechanic Advice

How To Do A Mississippi Dmv Change Of Address Moving Com

Where S My Mississippi State Tax Refund Taxact Blog

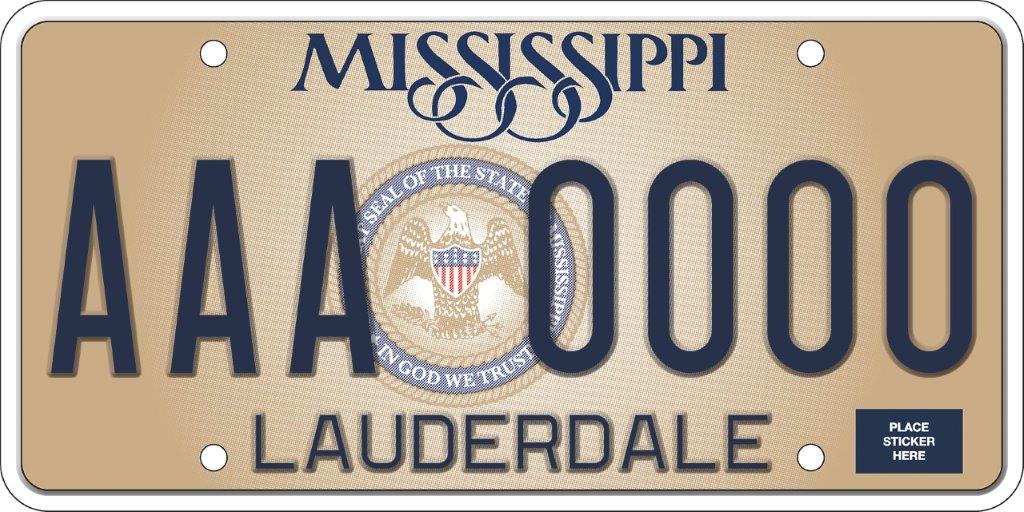

Tax Collector Lauderdale County

Lee County Tax Collector Mississippi

Dual Tax Status What Does It Mean For Your Pastor American Church Group Mississippi